Life

Everything you need to enjoy life. The latest entertainment and royal news from around the world, book recommendations and inspiration for your home

Latest

-

Kate Middleton's special Wimbledon promise to Princess Charlotte fulfilled after 'guilt'

The Princess of Wales and Princess Charlotte attended Wimbledon together last year as a 'treat' after a difficult year

By Emma Shacklock Published

-

Name a more classic Wimbledon combo than Duchess Sophie’s white blazer and dark sunglasses - I’ll wait

The Duchess of Edinburgh's jacket and sunnies pairing is timeless and is always very popular at SW19

By Emma Shacklock Published

-

Carole Middleton ditched heels for barely-there sandals as she blended style and comfort at Wimbledon

She went for an all-neutral outfit and her comfy flat sandals were a timeless and elegant addition

By Emma Shacklock Published

-

I put 5 top-rated fans under £20 on Amazon to the test - the clip-on fan is a game-changer for keeping cool on the go

Easy, affordable ways to stay cool as the weather warms up

By Kerrie Hughes Last updated

-

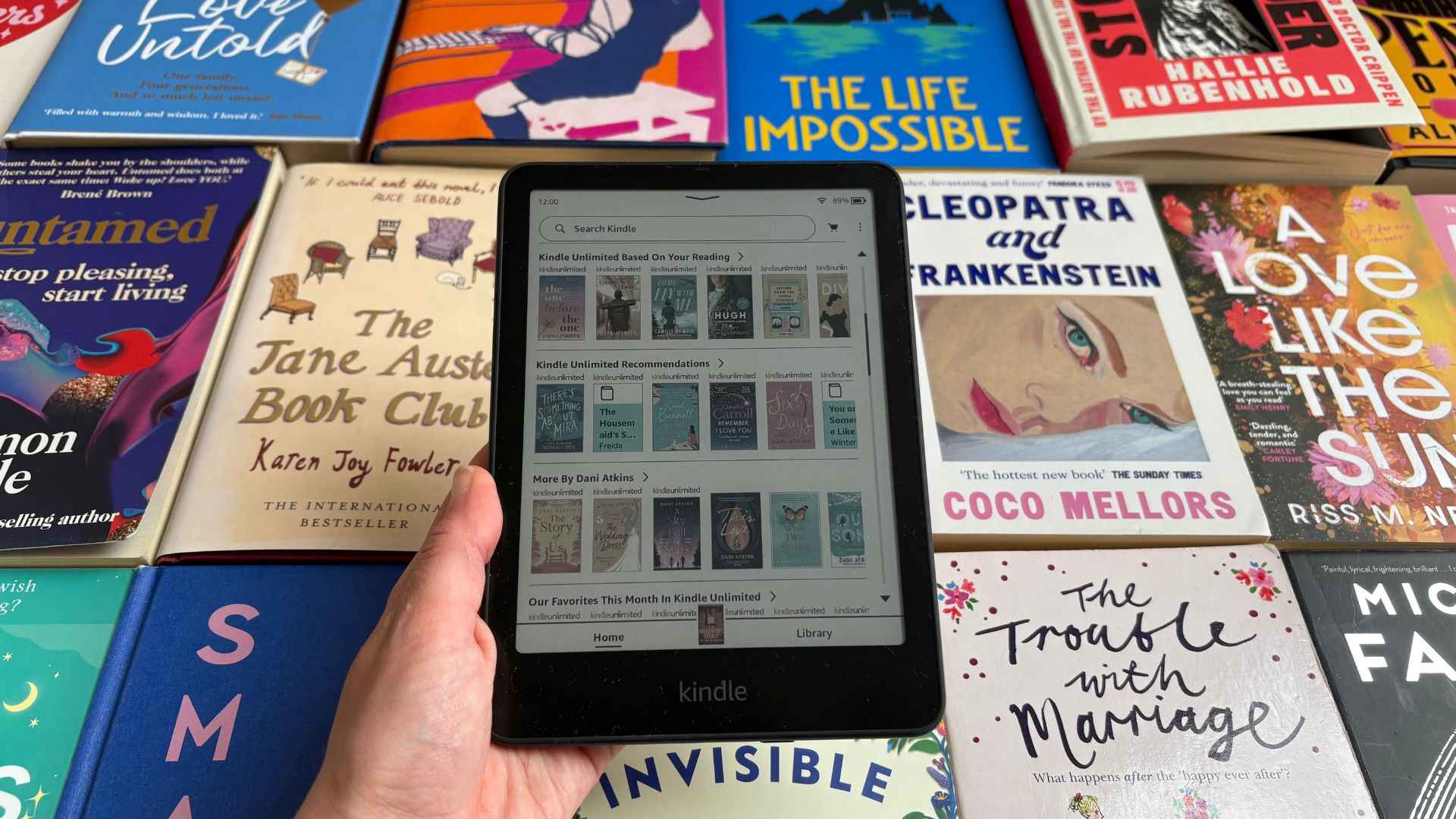

Best Kindle book deals and audiobook deals - free books and 99p page-turners and popular novels

I've found the best Kindle book deals available this Amazon Prime Day. From brand-news books to best-sellers, you can read these for free or 99p

By Laura Honey Last updated

-

Unexpectedly brilliant: Kindle Scribe is my favourite all-in-one device – get £100 off for Prime Day

Not what I expected, exactly what I needed

By Kerrie Hughes Published

-

The best new reads of summer 2025, as picked by woman&home's book editor

From thrillers to romance, non-fiction to sci-fi, here are my top summer book recommendations for 2025.

By Zoe West Published

-

Prime Day plot-twist: the best book, Kindle, and Audible deals are live now

Readers, assemble - Prime Day book deals are here and our all bookish dreams have come true

By Heidi Scrimgeour Published

-

The best Kindle deals for e-reading on the go

I've curated the best Kindle deals on offer on Amazon Prime Day, as well as some alternative eReader savings to help you save money on your collection

By Ella Taylor Last updated