Travel

The latest travel advice about travelling abroad as well as travel news and reviews on UK holidays, worldwide trips, hotels, cruises, train travel and more

Latest

-

These £10 packing cubes are a game-changer for organising (and squeezing in as much as I can in) my cabin bag

Tight on space in your carry on? This must-have travel accessory is the solution

By Kerrie Hughes Published

-

The (under £40) travel essentials I never go on holiday without

woman&home digital editor Kerrie Hughes shares her travel must-haves

By Kerrie Hughes Published

-

Flying easyJet or Ryanair and want a no-fail cabin bag? I found two quality options, tried and tested, for under £25

Lots of room and just the right carry-on size for Ryanair and easyJet, I use this affordable backpack every time I fly

By Kerrie Hughes Published

-

These are best luggage deals in May

Shop our guide to the best luggage deals worth snapping on this month, with brilliant savings on w&h's favourite cases and bags

By Kenedee Fowler Last updated

-

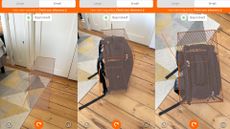

I can't believe I didn't know this at-home easyJet cabin bag size checker existed – and it's free to use

This little-known feature is a game-changer for helping ensure your easyJet cabin bag makes it onboard – and at no extra charge

By Kerrie Hughes Published

-

Incredible film locations to inspire your next getaway - from the tropical landscapes of Sri Lanka to the deserts of Jordan

These inspiring destinations are begging to be explored...

By Lydia Swinscoe Published

-

9 things to do in Oman for an incredible and memorable vacation

Thinking of Oman as a potential holiday destination? Here is what this beautiful country has to offer...

By Laura Harman Published

-

Mesmerising castles you can actually stay in - from a tranquil Japanese retreat to the luxurious Irish lodge celebrities and artists flock to

Get the royal treatment in one of these impressive chateâus...

By Lydia Swinscoe Published

-

The magical islands where celebrities and royals like to spend their downtime

In need of some holiday inspiration? These astonishing islands are sure to dazzle...

By Lydia Swinscoe Published