Life

Everything you need to enjoy life. The latest entertainment and royal news from around the world, book recommendations and inspiration for your home

Latest

-

"I never imagined I'd become a Lioness footballer" – Sarah Haskins on making her England Amputee debut

Sarah tells us how she came to represent England at the Women's Amputee Football World Cup, aged 43.

By Ellie Fennell Published

-

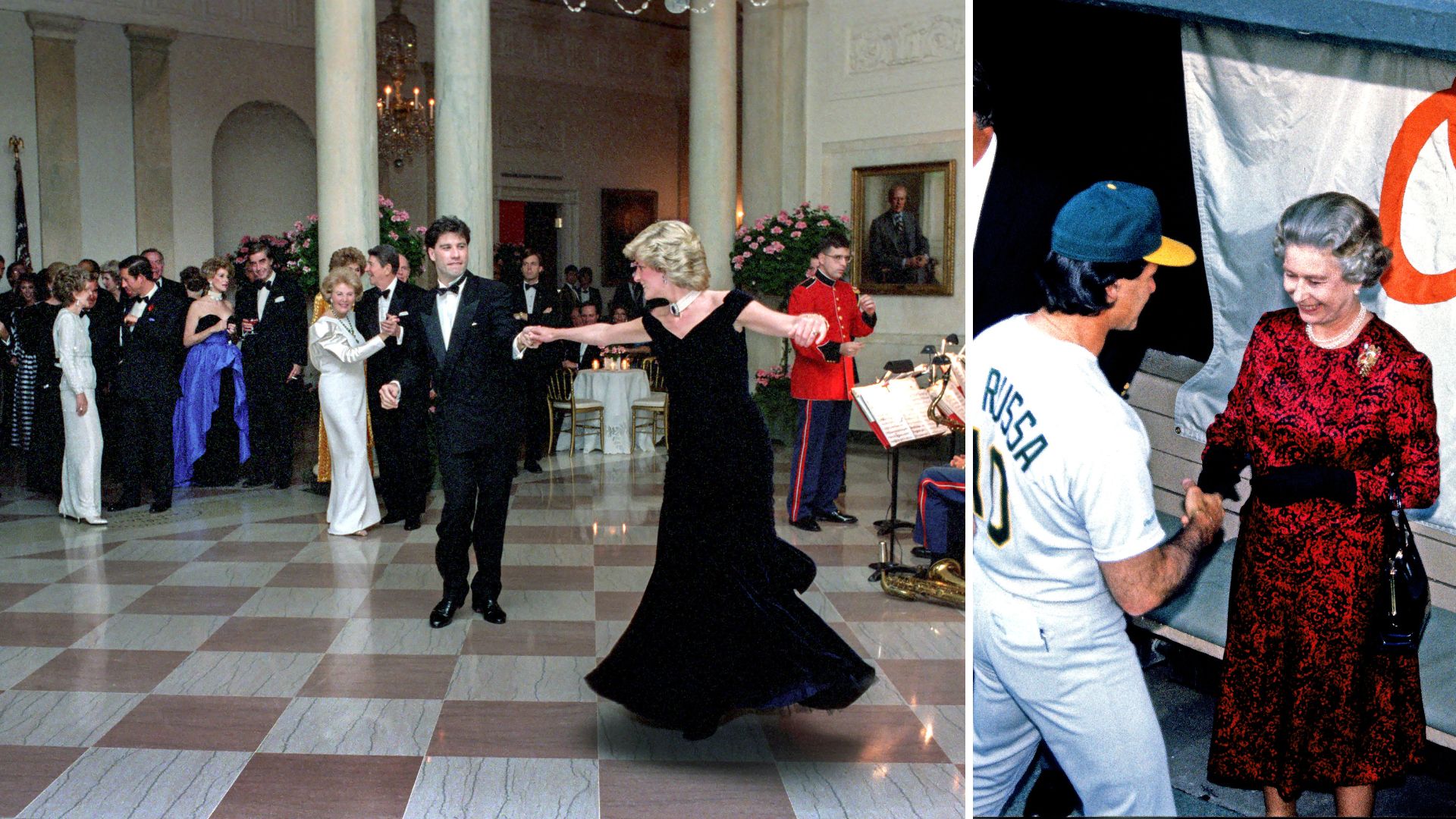

The British are coming: the best moments and stories from royals in the USA

The Beatles. The Spice Girls. The Royals. We take a look at some of our favorite UK exports...

By Jack Slater Published

-

Garden party ideas: 18 stylish ways to transform your outdoor space

These thoughtful garden party ideas are the best way to turn any outdoor gathering into a special occasion

By Tamara Kelly Last updated

-

Queen Camilla’s 78th birthday photo was taken in a deeply personal place - and I totally understand why

There is always something intriguing to discover in royal photos and the location where this was taken really struck me

By Emma Shacklock Published

-

What time is it? It's time to explore the royals' enviable watch collection, from vintage Cartier to gifts from presidents

We take a peek at the range of luxury watches that keep the Royal Family punctual for their engagements

By Jack Slater Published

-

Kate Middleton was 'fearless' during daring engagement - 'she clearly knows what she's doing'

The Princess of Wales throws herself into adventurous engagements and her efforts seriously impressed a British champion

By Emma Shacklock Published

-

If denim shorts aren’t for you, then Kate Middleton’s dusty green chino pair make a comfy everyday alternative

The Princess of Wales wore smart-casual shorts in The Bahamas in 2022 and this look provides a lot of inspiration

By Emma Shacklock Published

-

Nadiya Hussain is becoming the 'truest, most honest version' of herself after leaving the BBC

The chef says she's over trying to make her personality 'digestible' as she starts her career with a 'clean slate'

By Charlie Elizabeth Culverhouse Published

-

Queen Camilla embraces premium high street accessories with this new raffia bag - and it’s still available right now

Her Majesty stepped out with a cream Rixo bag that instantly caught my eye and it got a canine seal of approval

By Emma Shacklock Published