Life

Everything you need to enjoy life. The latest entertainment and royal news from around the world, book recommendations and inspiration for your home

Latest

-

Prince William says Princess Charlotte is 'getting there' with football in sweet moment with Lionesses

Prince William cheered on England’s women’s football squad and shared that Charlotte is coming round to the sport like her brothers

By Jack Slater Published

-

'I don't take any of it for granted' - Amal Clooney just shared rare insight into her and George's marriage

The human rights lawyer has touched on how supportive her husband George Clooney is

By Jack Slater Published

-

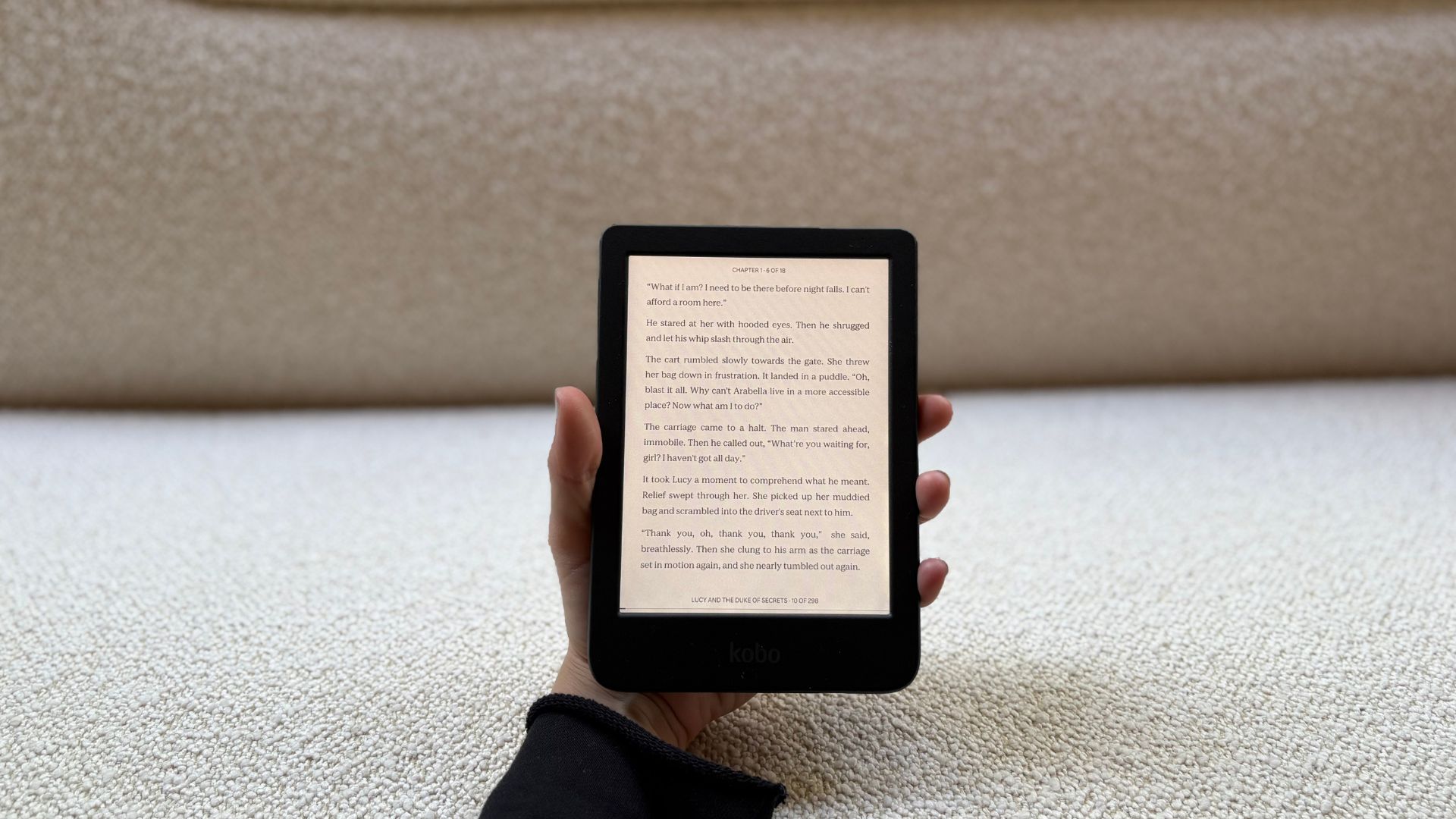

Is this the best value e-Reader? The Kobo Clara offers luxury for less

The Kobo Clara Colour is an eReader that enhances the everyday, with its colour screen, compact size, and robust built, it's exceptional value

By Laura Honey Published

-

Julia Bradbury 'so grateful for every day' after breast cancer journey

Countryfile star Julia Bradbury shares her new lease on life after beating breast cancer, and how a scan led to a new health discovery

By Jack Slater Published

-

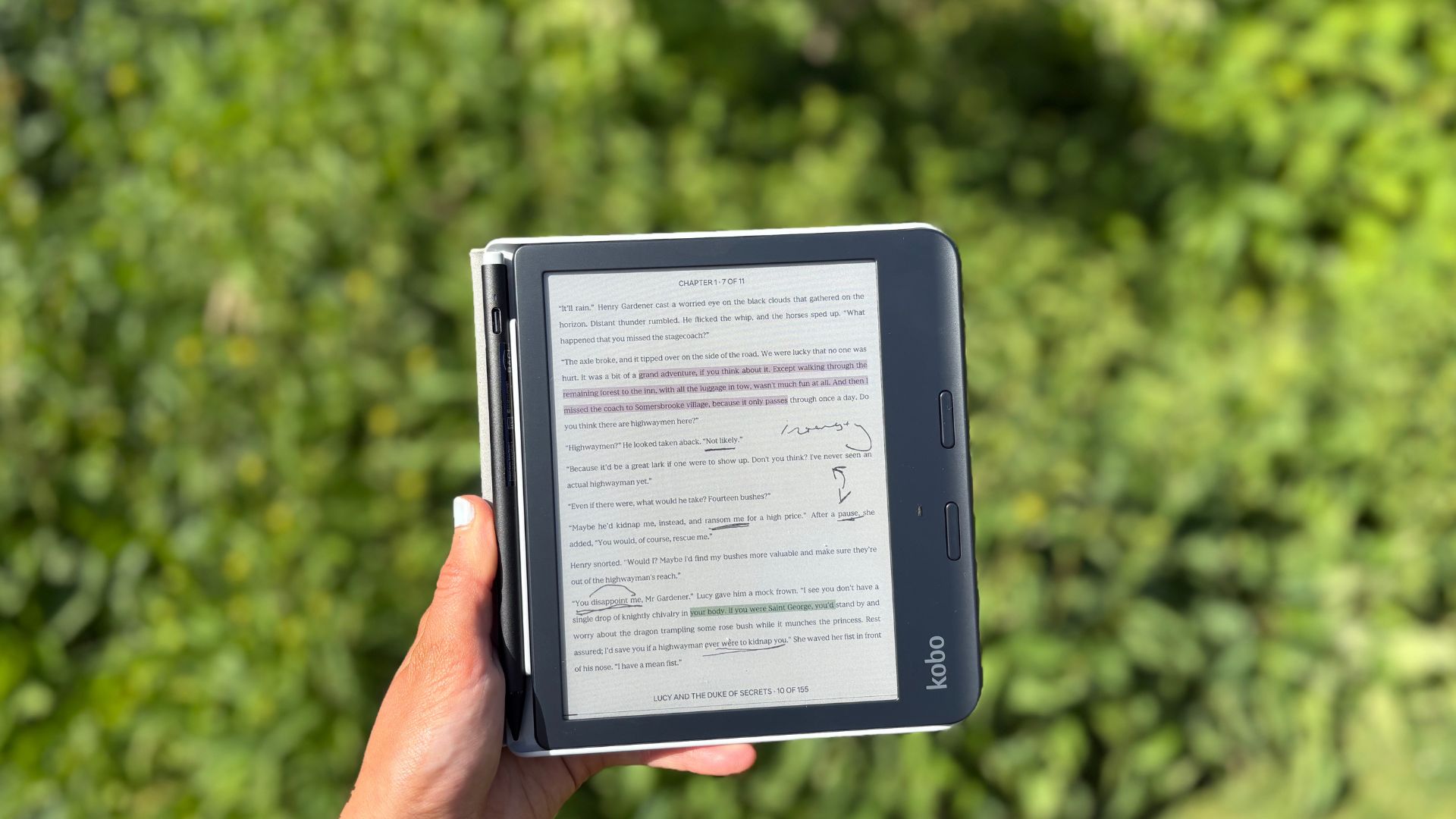

Missing the Kindle Oasis and page-turn buttons too? I have brilliant news

The Kobo Libra Colour boasts page turn buttons, colour, and stylus access. It's an advanced eReader that is replacing the Kindle Oasis, but is it for you?

By Laura Honey Published

-

I swapped my Kindle for a Kobo - is it a switch we should all be making?

The Kindle vs Kobo debate has been a longstanding one between eReader enthusiasts. I put the two head-to-head to help you find your perfect fit

By Laura Honey Published

-

Kate Middleton's relatable tea confession provides an insight into her life as a mum

The Princess of Wales loves a cup of tea and she joked about a lesson she's learnt about it since becoming a mum

By Emma Shacklock Published

-

Duchess Sophie's breezy striped dress, cool shades and go-to wedges scream sunny July days

The Duchess of Edinburgh definitely has a go-to summer outfit formula and the stripes brought something new to it

By Emma Shacklock Published

-

Kate Middleton just dazzled in tri-tone earrings - this is the sign to try mixing metals more this summer

The Princess of Wales re-wore her gorgeous Cartier Trinity earrings when she visited the RHS Wellbeing Garden

By Emma Shacklock Published