Life

Everything you need to enjoy life. The latest entertainment and royal news from around the world, book recommendations and inspiration for your home

Latest

-

8 items we're buying before Prime Day ends - and why you should too, but be quick!

With minutes to go until Prime Day ends, these are the items our team of expert writers were snapping up today

By Heidi Scrimgeour Published

-

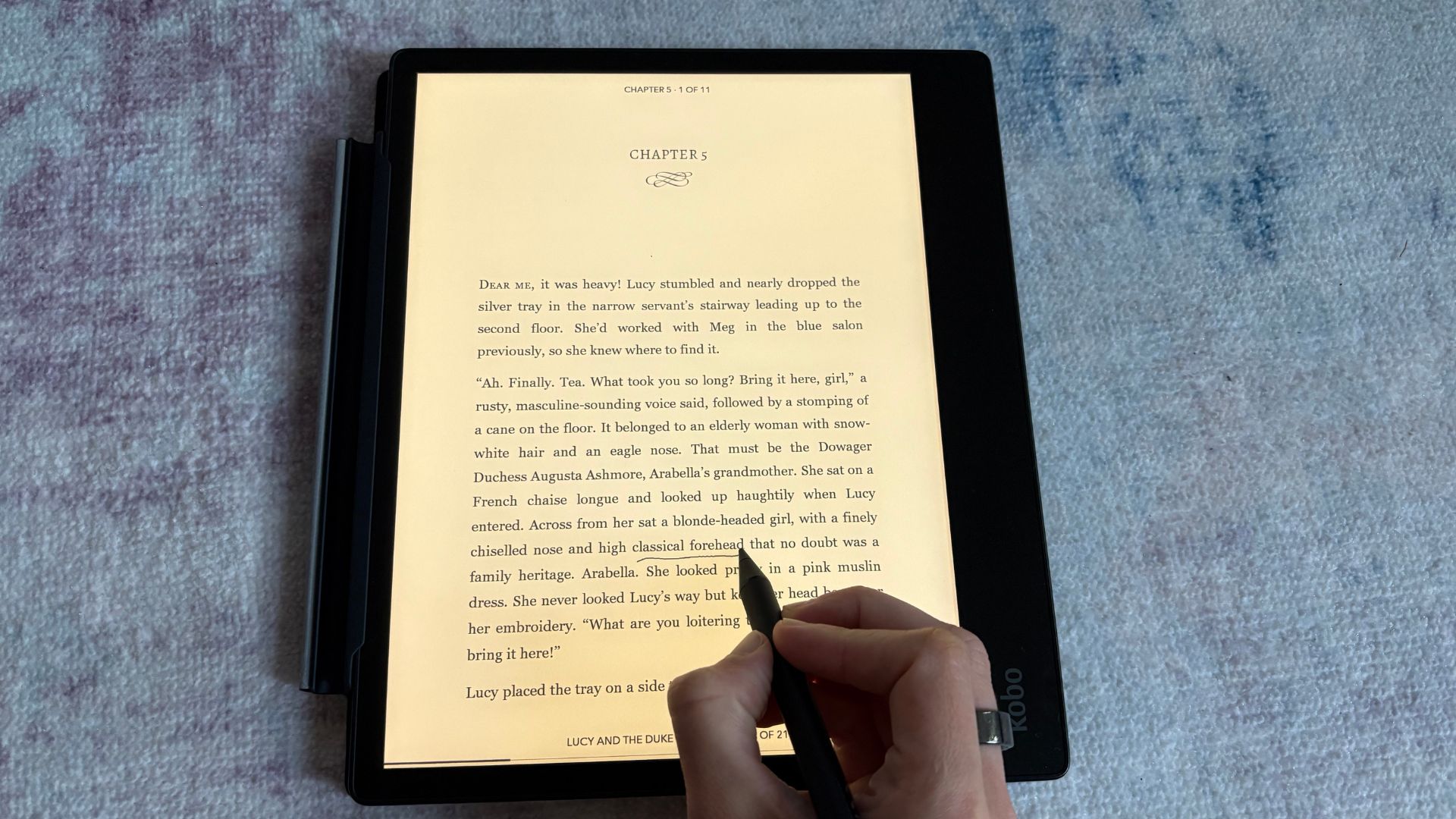

Which Kindle accessories do you actually need? Nine expert-recommended extras for your e-reader

I asked bookworms, the Kindle team, and Kindle users for the best Kindle accessories and then tested them out on Kindles, Kobos, and other e-readers

By Laura Honey Published

-

Duchess Sophie’s favourite tiara hasn’t always looked like that - it has a hidden trick

The Duchess of Edinburgh has worn the Wessex Aquamarine Tiara a staggering number of times, but in different ways

By Emma Shacklock Published

-

This is my 10th Amazon Prime Day, and this one is by far the biggest and best yet

Amazon Prime Day is here, and this year you have four days to shop deals across homes, health, beauty and fashion

By Heidi Scrimgeour Last updated

-

Love the vibe of the Kindle Scribe? You need to read about the Kobo Elipsa 2E - it's even better

The Kobo Elipsa 2E blends note-taking, annotating, and reading into one elegant tablet. Here's how it compares to Kindles and other Kobos

By Laura Honey Published

-

“I learned to thrive after surviving the pain of losing all my family by the age of 40”

A succession of unexpected bereavements left Wendy Smith, 56, trapped by grief. Here she shares how she finally found fulfilment and purpose in her 50s.

By Ellie Fennell Published

-

Martin Lewis shares his Prime Day shopping advice – including a little-known tip for saving an extra 20%

We're shopping experts here, but savvy enough to always learn more, especially from the Money Saving Expert himself.

By Ella Taylor Published

-

Queen Letizia's sophisticated shoulder-baring little black dress is inspiring me to go strapless this summer

We rarely see the royals in strapless designs but the Queen of Spain threw those fashion rules out the window this month

By Emma Shacklock Published

-

Prime Day plot-twist: the best book, Kindle, and Audible deals are live now

We roundup the best Amazon book deals, Kindle book deals, and Audible deals in one place, with advice from publishers, our books editor, and other book worms

By Heidi Scrimgeour Last updated