Life

Everything you need to enjoy life. The latest entertainment and royal news from around the world, book recommendations and inspiration for your home

Latest

-

Beat the heat in style like Kate Middleton - her floppy Wimbledon sun hat is back in stock

The Princess of Wales's wide-brimmed hat was a gorgeous - and practical - addition to her 2022 Wimbledon outfit.

By Emma Shacklock Published

-

'It's scary because we don't know enough about it' – Anna Williamson on navigating fears around letting kids have phones

The Great British Phone Switch host thinks phones can be safe for teens if the right boundaries are in place

By Caitlin Elliott Published

-

King Charles' sweet insight into life as a grandpa proves he's hands-on with his grandchildren

King Charles hosted an event at Buckingham Palace and ended up discussing all things parenting with TV presenter Declan Donnelly

By Jack Slater Published

-

Seeing stripes? Princess Beatrice's baby blue Wimbledon co-ord shows why they're a classic

Princess Beatrice is the first British royal to attend Wimbledon 2025 and her Sandro shirt and skirt are trés chic.

By Emma Shacklock Published

-

Carole Middleton's elegant Wimbledon outfit formula is a failsafe style for so many summer occasions

What’s not to love about a beautiful outfit combination that’s easy to put together and comfortable to wear?

By Emma Shacklock Published

-

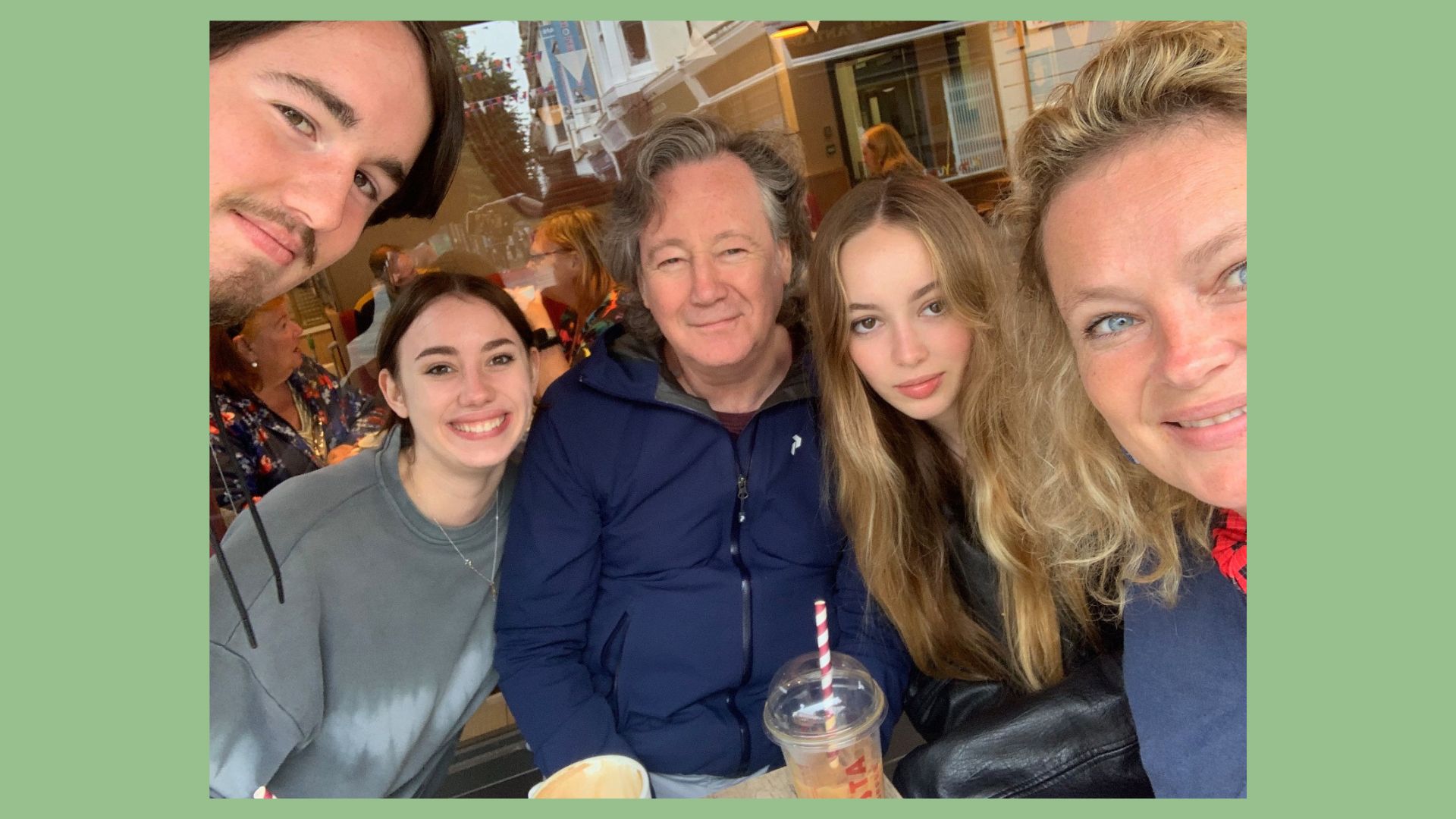

“My husband died suddenly, leaving me with three kids – but I'm turning things around now”

Lucy Melville’s husband of 25 years died not even three months after he was diagnosed with cancer. Not long after, she lost her job.

By Lauren Crosby Medlicott Published

-

'She's listening to her body, instead of being a people pleaser' - Kate Middleton’s mindful return to royal duties is something we should all take note of

The Princess of Wales is reportedly 'disappointed' to be missing out on royal events, but knows that she needs to take things slow

By Charlie Elizabeth Culverhouse Published

-

“I’m a busy working mum but discovered a love of bellringing – here's why I love it”

Ever wondered what's behind the sound of church bells? Executive Assistant Sarah took up this unusual hobby in her 40s

By Ellie Fennell Published

-

Weekly horoscope: 2 astrologers' predictions for 30th June - 6th July 2025

Read your weekly horoscope from Sally Trotman and Penny Thornton who reveal what this week holds for every star sign on love, family, career, and more

By Penny Thornton Published